The Transformative Power of Compound Interest: Building Sustainable Wealth

Introduction: Unveiling the Path to Wealth

The dream of becoming a millionaire might seem unattainable to many, a fantasy reserved for a lucky few or heirs. However, the reality is that building lasting wealth is rarely the result of a stroke of luck or an exorbitant salary. Instead, it emerges from the consistent application of simple, yet powerful, financial principles over time. Millionaires, for the most part, are not defined by extravagant spending or an immediate life of luxury, but rather by a mindset and financial habits that prioritize long-term growth. This article will unveil some of the most impactful lessons from individuals who built their own fortunes, showing how you can start applying these teachings to your life today, transforming small amounts into significant assets through the power of compound interest.

1. Live Below Your Means: The Foundation of Wealth Accumulation

Contrary to the popular image of wealth, one of the most striking characteristics of self-made millionaires is moderation. They do not seek to impress with expensive material possessions; instead, they practice restraint and avoid unnecessary debt. They drive modest cars, live in comfortable but not luxurious homes, and prioritize asset accumulation over liabilities. The lesson here is clear: true wealth is not manifested in ostentation, but in the ability to build a solid and quiet patrimony. By spending less than you earn, you create a financial margin that can be directed towards investments, significantly accelerating your path to financial independence. Think of every dollar saved as a seed planted that, over time, will germinate and yield abundant fruits.

2. Pay Yourself First: Prioritizing Your Financial Future

Millionaires do not wait to see what is left at the end of the month to save. They reverse this logic: saving and investing are the first “bills” to be paid. As soon as the salary comes in, a predefined portion (be it 10%, 20%, or more) is automatically transferred to savings or investment accounts. This discipline ensures that wealth building is a non-negotiable priority, and not a last-minute option. Automation is key here, as it removes the temptation to spend that money even before it reaches your checking account. By paying yourself first, you are literally investing in your future, ensuring that your financial goals are achieved consistently and without interruption.

3. Invest Early and Consistently: The Secret of Compound Interest

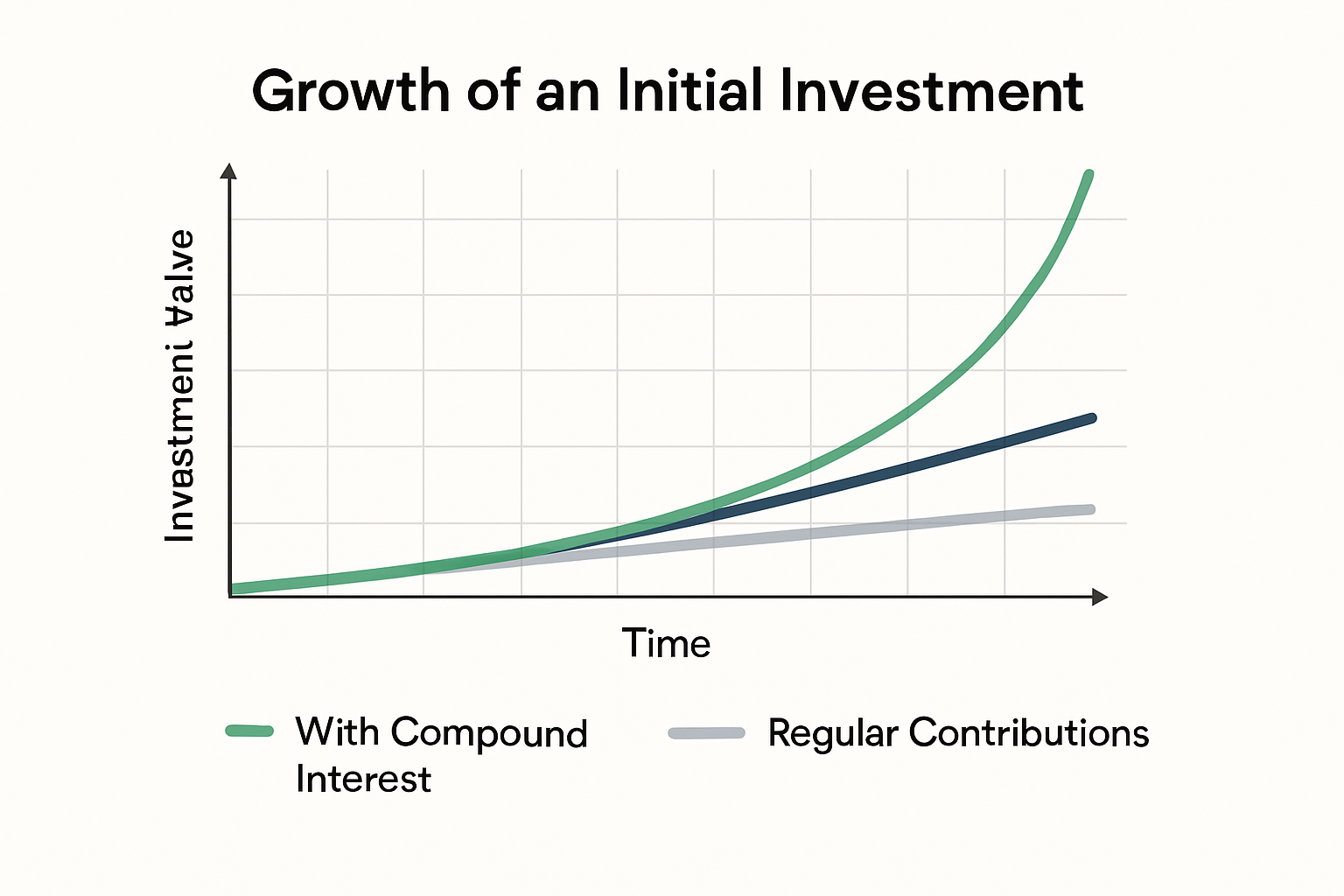

Wealth is not built overnight; it is the result of consistent and strategic investments over decades. Millionaires deeply understand the power of compound interest – the concept that your earnings also generate earnings, creating a snowball effect. Starting to invest early is crucial, as time is the greatest ally of compound interest. Even small contributions, when invested regularly and for a long period, can turn into impressive sums. The key is to stay invested, even in the face of market fluctuations, as history shows that, in the long run, markets tend to grow. For example, investing $200 per month at an annual interest rate of 8% can result in over $200,000 in 20 years, and over $600,000 in 30 years, demonstrating the exponential impact of time and consistency.

4. Diversify Your Income Streams: Protection and Opportunity

Most millionaires do not rely on a single source of income. They build multiple streams, which may include investments, side businesses, rental properties, royalties, or other forms of passive income. This diversification not only protects against risks (such as losing a primary job), but also creates more opportunities for financial growth. You can start small, developing a skill that can be monetized in a freelance job, creating a digital product, or investing in assets that generate passive income. The idea is to build a financial safety net that allows for greater freedom and resilience, regardless of economic conditions.

5. Focus on Long-Term Goals: The Millionaire’s Vision

Millionaires think in decades, not weeks. They are patient with their investments, disciplined with their savings, and strategic with their career decisions. Instead of seeking quick gains or immediate solutions, they remain focused on the bigger picture: financial independence. Ask yourself: where do you want to be financially in 10, 20, or 30 years? Setting clear, long-term goals helps maintain discipline and make financial decisions aligned with your larger objectives. This long-term vision allows them to overcome small adversities and stay the course, knowing that the ultimate reward is much greater than any instant gratification.

6. Avoid Lifestyle Inflation: Maintain Financial Discipline

As income grows, it is natural and tempting to raise one’s standard of living. However, millionaires often resist this common trap, known as “lifestyle inflation.” Instead of spending more as they earn more, they keep their lifestyle relatively stable and invest the difference. This practice drastically accelerates wealth accumulation, as more capital is directed towards income-generating assets. For example, if your salary increases by 10%, but your expenses remain the same, that additional 10% can be fully invested, boosting the effect of compound interest. The discipline of living below your means, even with a growing income, is a fundamental pillar for building a fortune.

7. Value Financial Education: Invest in Knowledge

Self-made millionaires are continuous learners. They dedicate time to reading books, attending seminars, and surrounding themselves with successful people. The average millionaire reads significantly more than the average person, focusing on personal finance, self-improvement, and business. Every book, course, or mentorship can be a stepping stone to smarter and more strategic financial decisions. Investing in your own financial knowledge is one of the best investments you can make, as it empowers you to make informed decisions, identify opportunities, and avoid financial pitfalls. Knowledge is the true power on the journey to wealth.

8. Take Calculated Risks: Growth Requires Courage

Millionaires do not shy away from risk, but they are not impulsive gamblers either. They research, plan, and take calculated risks that offer significant growth potential. Whether investing in a new business, real estate, or the stock market, they understand that smart risks are often necessary to build substantial wealth. This does not mean betting everything, but rather carefully evaluating opportunities, understanding potential returns and losses, and making decisions based on solid information. The ability to manage risk and make bold, yet well-founded, decisions is a distinguishing characteristic of those who achieve financial success.

9. Protect Your Money: Safeguarding Assets

Building wealth is one step; protecting it is another equally crucial one. Millionaires use strategies such as insurance (life, health, property), estate planning, and investment diversification to safeguard what they have earned. Even if you are not yet a millionaire, it is prudent to have a robust emergency fund, adequate health insurance, and a plan for unexpected events. Protecting your assets means ensuring that an unexpected event does not destroy years of effort and financial discipline. Asset protection is as important as its accumulation, ensuring the longevity of your financial security.

10. Give Back to the Community: The Purpose of Wealth

Interestingly, many millionaires practice generosity. They donate to causes they believe in, mentor others, and invest in their communities. Giving back not only helps others but also creates a sense of purpose and personal fulfillment. This demonstrates that wealth is not just about money, but also about the positive impact one can generate in the world. Philanthropy and community engagement are aspects that many wealthy individuals value, finding a deeper meaning in their fortune by using it for the greater good. This perspective adds a human and inspiring dimension to the wealth-building journey.

Conclusion: Your Journey to Wealth Starts Now

Millionaires rarely are born rich; they become rich through discipline, patience, and intentionality in their finances. By living below your means, investing consistently, avoiding unnecessary debt, and focusing on long-term goals, you can adopt the same habits that create lasting wealth. Remember: the journey to wealth is built step by step, with each small financial decision contributing to a more prosperous future. Start today, maintain consistency, and watch your assets grow exponentially. Wealth is a marathon, not a sprint, and every step counts.